Replicate Fama French 5-Factor Model from publicly available data sources

As an equity quantitative analyst, you have recurring positioning analysis tasks. Your most effective approach is to model your object of study (usually stocks, portfolios or indexes) and decompose its behavior into common risk factors. You can create your own “factor model” or use existing models. There are robust models generated by data providers like MSCI or Qontigo, which are quite expensive but necessary for large institutions. Otherwise you have lighter academic models like the famous five-factor model developed by Fama-French.

In this article, we will try to reproduce the last one.

The FF-5 model is freely available but it is published with a 2 month lag, which is why it is interesting to create a proxy to recover these missing months, in order to produce a live analysis.

One difficulty that immediately arises is the sourcing of data. Academic research often use CRSP database. But it is reserved for academic practitioners and not free. We can wonder if we can reproduce, or at least have very close results, with publicly available data. For that, we will leverage the python library yfinance which interacts with Yahoo Finance APIs to download all the financial data we will need.

For the automatic download of Fama French original data, please refer to this previous article.

import pandas as pd import numpy as np import yfinance as yf import requests from tqdm import tqdm import statsmodels.api as sm

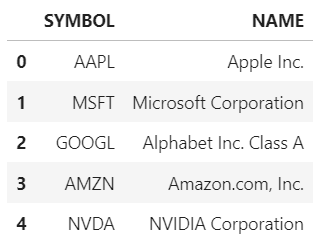

We start with a list containing around 2500 tickers of US stocks (~99% of US market cap).

ticker_list.head()

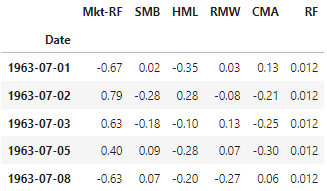

We load Fama French factor returns, these are the timeseries that we will try to replicate.

data_ff.head()

We have to specify a few dates to request the data. Following Fama French website methodology, portfolios are made each year at the end of June, with most recent fundamental data available at the end of last calendar year. Here we create the June 2023 baskets, to assess replication from July 2023 to maximum June 2024. Last calendar year is 2022.

start_date = "2021-12-31" end_date = "2024-03-29" start_year_y1 = "2022-01-01" end_year_y1 = "2022-12-30" cutoff_year = "2022-12" cutoff_date = "2023-06-30" cutoff_date_y1 = "2022-06-30" last_ff_date = "2024-01-31" risk_free_rate = data_ff.RF.iloc[-1] # we take the last available risk free rate number

We request, from yahoo api, the following metrics: operating income (or net income if missing), total assets, stockholder’s equity, number of shares and shares close prices.

operating_income = pd.DataFrame() # needed for RMW

total_assets = pd.DataFrame() # needed for CMA

book_value = pd.DataFrame() # needed for HML

nb_shares = pd.DataFrame(index=pd.date_range(start_year_y1, cutoff_date, freq="D")) # number of stock's shares

share_price = pd.DataFrame() # prices

s = requests.Session()

for this_ticker in tqdm(ticker_list.SYMBOL):

stock = yf.Ticker(this_ticker, session=s)

if stock.financials.empty: # check if ticker exists, otherwise skip stock

continue

# operating income

try: # standard formula

if operating_income.empty:

operating_income = stock.financials.loc["Operating Income"].rename(this_ticker)

else:

operating_income = pd.concat([operating_income, stock.financials.loc["Operating Income"].rename(this_ticker)], axis=1)

except:

try: # if operating income metric is missing, we take net income

if operating_income.empty:

operating_income = (stock.financials.loc['Net Income']).rename(this_ticker)

else:

operating_income = pd.concat([operating_income, (stock.financials.loc['Net Income']).rename(this_ticker)], axis=1)

except: # otherwise skip this stock

continue

# total asset

if total_assets.empty:

total_assets = stock.balance_sheet.loc["Total Assets"].rename(this_ticker)

else:

total_assets = pd.concat([total_assets, stock.balance_sheet.loc["Total Assets"].rename(this_ticker)], axis=1)

# book value

if book_value.empty:

book_value = stock.balance_sheet.loc["Stockholders Equity"].rename(this_ticker)

else:

book_value = pd.concat([book_value, stock.balance_sheet.loc["Stockholders Equity"].rename(this_ticker)], axis=1)

# number of shares

try: #first method

nb_shares_new = stock.get_shares_full(start=start_year_y1, end=cutoff_date).rename(this_ticker).drop_duplicates().tz_localize(None)

nb_shares.loc[nb_shares_new.index, this_ticker] = nb_shares_new

except: # if no data, test second method

nb_shares_new = stock.balance_sheet.loc["Ordinary Shares Number"].rename(this_ticker)

nb_shares.loc[:, this_ticker] = nb_shares_new.loc[nb_shares_new.index.isin(nb_shares.index)]

# price of share

if share_price.empty:

share_price = stock.history(start=start_date, end=end_date).Close.rename(this_ticker)

else:

share_price = pd.concat([share_price, stock.history(start=start_date, end=end_date).Close.rename(this_ticker)], axis=1)

share_price.index = pd.to_datetime(share_price.index.strftime("%Y%m%d"))

share_return = (share_price / share_price.shift(1) - 1).fillna(0) # compute price returnsNow with the downloaded raw data, we can compute the fundamental metrics & ratios.

factor_metric = pd.DataFrame(index=ticker_list.SYMBOL, columns=["HML", "SMB", "RMW", "CMA"], dtype="float") # SMB: price x nb shares = market cap market_cap = share_price.loc[cutoff_date] * nb_shares.infer_objects().ffill().loc[cutoff_date] factor_metric.loc[market_cap.index, "SMB"] = market_cap # HML: book to market ratio book_market = book_value.infer_objects().ffill().loc[cutoff_year] / (share_price.loc[end_year_y1] * nb_shares.infer_objects().ffill().loc[end_year_y1]) factor_metric.loc[book_market.columns, "HML"] = book_market.values # RMW: operating income / book value operating_profit = operating_income.infer_objects().ffill().loc[cutoff_year] / book_value.infer_objects().ffill().loc[cutoff_year] factor_metric.loc[operating_profit.columns, "RMW"] = operating_profit.values # CMA: total asset 1Y growth investment = total_assets.infer_objects().ffill().loc[cutoff_date] / total_assets.infer_objects().ffill().loc[cutoff_date_y1] - 1 factor_metric.loc[investment.index, "CMA"] = investment

We filter the investment universe to keep only stocks that have positive book to market ratios. We compute metrics thresholds to map stocks into the long and short legs.

filtered_metric = factor_metric[factor_metric.HML > 0].copy() # Define thresholds mktcap_threshold = filtered_metric.SMB.quantile(0.5) high_threshold = filtered_metric.HML.quantile(0.7) low_threshold = filtered_metric.HML.quantile(0.3) robust_threshold = filtered_metric.RMW.quantile(0.7) weak_threshold = filtered_metric.RMW.quantile(0.3) aggress_threshold = filtered_metric.CMA.quantile(0.7) conserv_threshold = filtered_metric.CMA.quantile(0.3)

We create 4 baskets for each factor (HML, RMW, CMA). No need for SMB, as it is a combination of these.

basket_compo = filtered_metric.copy().drop(columns=["SMB"]) # HML basket_compo['HML'] = None basket_compo['HML'] = basket_compo['HML'].astype(str) basket_compo.loc[(filtered_metric.SMB < mktcap_threshold) & (filtered_metric.HML >= high_threshold), "HML"] = "small_high" basket_compo.loc[(filtered_metric.SMB < mktcap_threshold) & (filtered_metric.HML <= low_threshold), "HML"] = "small_low" basket_compo.loc[(filtered_metric.SMB >= mktcap_threshold) & (filtered_metric.HML >= high_threshold), "HML"] = "big_high" basket_compo.loc[(filtered_metric.SMB >= mktcap_threshold) & (filtered_metric.HML <= low_threshold), "HML"] = "big_low" # RMW basket_compo['RMW'] = None basket_compo['RMW'] = basket_compo['RMW'].astype(str) basket_compo.loc[(filtered_metric.SMB < mktcap_threshold) & (filtered_metric.RMW >= robust_threshold), "RMW"] = "small_robust" basket_compo.loc[(filtered_metric.SMB < mktcap_threshold) & (filtered_metric.RMW <= weak_threshold), "RMW"] = "small_weak" basket_compo.loc[(filtered_metric.SMB >= mktcap_threshold) & (filtered_metric.RMW >= robust_threshold), "RMW"] = "big_robust" basket_compo.loc[(filtered_metric.SMB >= mktcap_threshold) & (filtered_metric.RMW <= weak_threshold), "RMW"] = "big_weak" # CMA basket_compo['CMA'] = None basket_compo['CMA'] = basket_compo['CMA'].astype(str) basket_compo.loc[(filtered_metric.SMB < mktcap_threshold) & (filtered_metric.CMA >= aggress_threshold), "CMA"] = "small_aggress" basket_compo.loc[(filtered_metric.SMB < mktcap_threshold) & (filtered_metric.CMA <= conserv_threshold), "CMA"] = "small_conserv" basket_compo.loc[(filtered_metric.SMB >= mktcap_threshold) & (filtered_metric.CMA >= aggress_threshold), "CMA"] = "big_aggress" basket_compo.loc[(filtered_metric.SMB >= mktcap_threshold) & (filtered_metric.CMA <= conserv_threshold), "CMA"] = "big_conserv"

We have all the data needed to compute returns for long and short baskets for each factor. In the FF methodology factors are composed in June and weights are kept constant every day until June Y+1.

basket_weight = filtered_metric.copy().drop(columns=["SMB"])

basket_hml = pd.DataFrame(index=share_return.index, columns=["small_high", "small_low", "big_high", "big_low"])

basket_rmw = pd.DataFrame(index=share_return.index, columns=["small_robust", "small_weak", "big_robust", "big_weak"])

basket_cma = pd.DataFrame(index=share_return.index, columns=["small_aggress", "small_conserv", "big_aggress", "big_conserv"])

# HML

basket_weight["HML"] = np.nan

for bskt in basket_hml.columns:

# compute weight, which is market cap weighted

basket_weight.loc[basket_compo.HML == bskt, "HML"] = filtered_metric[basket_compo.HML == bskt].SMB / filtered_metric[basket_compo.HML == bskt].SMB.sum()

ret = share_return.loc[:, basket_compo[basket_compo.HML == bskt].index] # get returns of selected stocks

wgt = basket_weight[basket_compo.HML == bskt].HML.values # get weighting of selected stocks

basket_hml[bskt] = ret @ wgt.T # compute basket weighted performance

# same for RMW and CMA

# ...

# MARKET: We market cap weight the investment universe and compute historical weights

basket_weight["MKT_WEIGHT"] = filtered_metric.SMB / filtered_metric.SMB.sum()

raw_wgt = (basket_weight["MKT_WEIGHT"].values * (1+share_return.loc[:, basket_weight.index].shift(1).fillna(0)/100).cumprod())

wgt = (raw_wgt.T / raw_wgt.sum(axis=1)).TAs we have the returns of all baskets, we can compute the factors (long/short) performances. Factors are immunized against Size effect, so we subtract the mean of small & big long leg with the mean of small & big short leg. For SMB, we use the other factors to compute it.

ff_proxy = pd.DataFrame(index=share_return.index)

ff_proxy["MKT_proxy"] = (share_return.loc[:, basket_weight.index] * wgt).sum(axis=1) - risk_free_rate/100

ff_proxy["HML_proxy"] = 0.5 * (basket_hml.small_high + basket_hml.big_high) - 0.5 * (basket_hml.small_low + basket_hml.big_low)

ff_proxy["RMW_proxy"] = 0.5 * (basket_rmw.small_robust + basket_rmw.big_robust) - 0.5 * (basket_rmw.small_weak + basket_rmw.big_weak)

ff_proxy["CMA_proxy"] = 0.5 * (basket_cma.small_conserv + basket_cma.big_conserv) - 0.5 * (basket_cma.small_aggress + basket_cma.big_aggress)

ff_proxy["SMB_proxy"] = (1/3) * 0.5 * ( (basket_hml.small_high + basket_hml.small_low + basket_rmw.small_robust + basket_rmw.small_weak + basket_cma.small_conserv + basket_cma.small_aggress)

- (basket_hml.big_high + basket_hml.big_low + basket_rmw.big_robust + basket_rmw.big_weak + basket_cma.big_conserv + basket_cma.big_aggress))We can now compare the computed proxy timeseries with official FF timeseries.

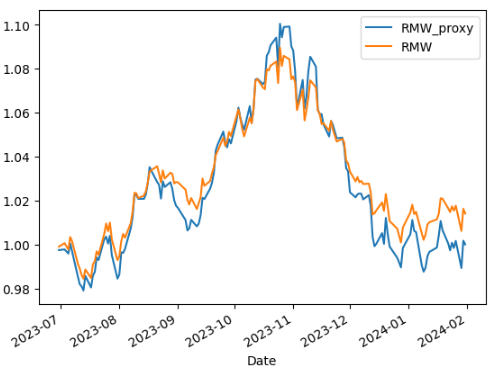

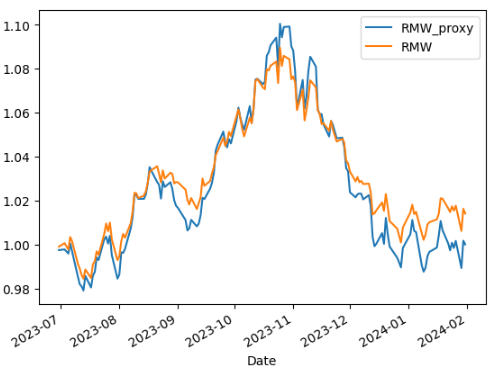

comp_rmw = pd.merge(ff_proxy.RMW_proxy[:last_ff_date], data_ff.RMW[cutoff_date:]/100, how='left', left_index=True, right_index=True).dropna() corr_rmw = comp_rmw.corr().iloc[0,1] beta_rmw = (comp_rmw.cov() / comp_rmw.RMW.var()).iloc[0,1] (1+comp_rmw).cumprod().plot()

| Factor | Correlation versus FF Factor | Beta versus FF Factor |

| Mkt-RF | 99.52% | 1.00 |

| SMB | 98.28% | 1.11 |

| HML | 92.46% | 0.85 |

| RMW | 93.92% | 1.16 |

| CMA | 89.77% | 0.95 |

We have pretty good correlations versus the original FF5 factors (as we did not do much refinement on data filtering). We just have to adjust for leverage (i.e. beta) to correctly scale our proxies.

ff_proxy_adjusted = ff_proxy.copy() ff_proxy_adjusted["MKT_proxy"] = ff_proxy_adjusted["MKT_proxy"] / beta_mkt ff_proxy_adjusted["HML_proxy"] = ff_proxy_adjusted["HML_proxy"] / beta_hml ff_proxy_adjusted["SMB_proxy"] = ff_proxy_adjusted["SMB_proxy"] / beta_smb ff_proxy_adjusted["CMA_proxy"] = ff_proxy_adjusted["CMA_proxy"] / beta_cma ff_proxy_adjusted["RMW_proxy"] = ff_proxy_adjusted["RMW_proxy"] / beta_rmw

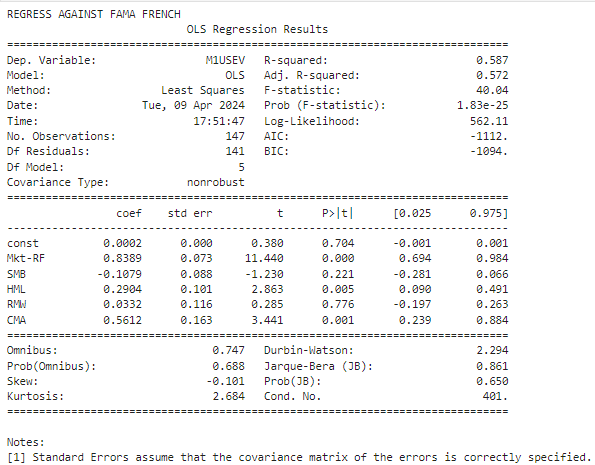

To test the quality of our proxies, we can upload a US index timeseries that we will regress against our 2 factor sets.

# we load an index total return timeserie

index_usa = pd.read_csv("index_usa.csv")

index_usa.dte_Date = pd.to_datetime(index_usa.dte_Date, format="%Y-%m-%d")

index_usa = index_usa.set_index("dte_Date")

start_date = "2023-06-30"

end_date = "2024-01-31"

print("REGRESS AGAINST FAMA FRENCH")

y_ff = index_usa[start_date:end_date]

X_ff = data_ff.drop(columns=["RF"])[start_date:end_date]

y_ff = y_ff[y_ff.index.isin(X_ff.index)]

X_ff = X_ff[X_ff.index.isin(y_ff.index)]

model_ff = sm.OLS(y_ff, sm.add_constant(X_ff/100))

res_ff = model_ff.fit()

print(res_ff.summary())

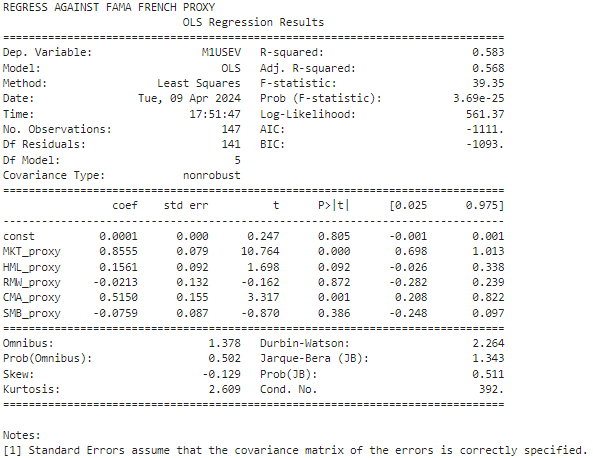

print("REGRESS AGAINST FAMA FRENCH PROXY")

y = index_usa[start_date:end_date]

X = ff_proxy_adjusted.drop(columns=["RF"])[start_date:end_date]

y = y[y.index.isin(X.index)]

X = X[X.index.isin(y.index)]

model = sm.OLS(y, sm.add_constant(X))

res = model.fit()

print(res.summary())

We got pretty similar results, near R² scores and close estimated betas.

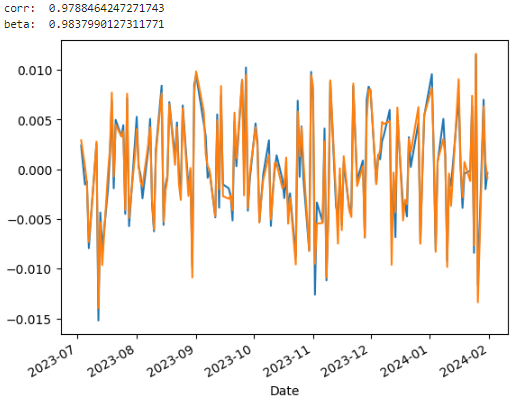

Now we can check if the residuals are close too.

res_ff.resid.plot()

res.resid.plot()

comp_resid = pd.merge(res_ff.resid.rename("ff"), res.resid.rename("proxy"), how="inner", left_index=True, right_index=True)

print("corr: ", comp_resid.corr().iloc[0,1])

print("beta: ", (comp_resid.cov() / comp_resid.ff.var()).iloc[0,1])

Correlation is near 98%!

To conclude, we denoised quite similarly the index timeseries with both proxy and FF factor sets. We can therefore use these proxy factors to fill in the missing data over 2 months. This will allow us to use this factor model for live investing/trading models. Free data here does not degrade much modeling performance.